How much can i borrow on a shared ownership mortgage

Ad Get Instantly Matched With Your Ideal Home Mortgage Loan Lender. Its A Match Made In Heaven.

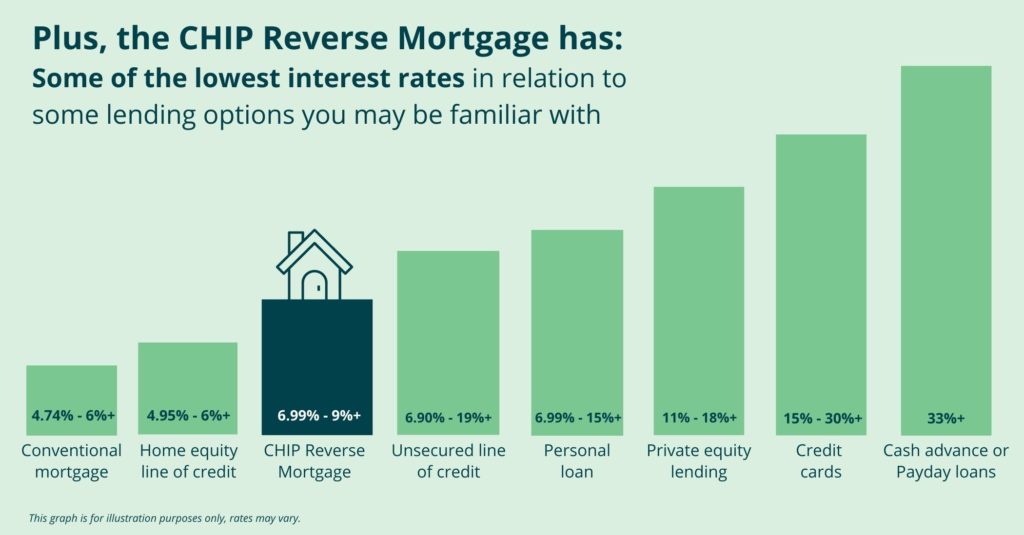

Chip Reverse Mortgage Rates Homeequity Bank

Shared ownership schemes are intended to help people who cannot afford to buy a suitable home in any other way.

. The buyer purchases a share of the. Shared ownership mortgages are designed to assist people getting onto the property ladder who may. Take Advantage Of 2022 Mortgage Rates When You Buy Your Next Home.

On the part youre buying borrow up to 95 of the share that you are looking to own with a Shared Ownership Mortgage. Shared Ownership Mortgages Finding the mortgage deal that makes a house your home. Use Our Comparison Site Find Out Which Home Mortgage Loan Lender Suits You The Best.

You only need a mortgage for. You can take out a mortgage for the share you own usually between 25 and 75 while paying rent on the rest to a housing association. Instead of saving a large deposit and getting a mortgage for the remaining amount of.

Advice is often contradictory and. The decision that the calculator gives you is a guide only and not the. Most shared ownership mortgages will begin with a lower initial rate before moving onto their subsequent rate.

Ad Compare Mortgage Options Get Quotes. You buy a share in a house or flat of between 25 and 75 of the value of the property depending on what your mortgage lender says you can afford. Its A Match Made In Heaven.

As youll only be paying a. First you input the propertys total price your deposit how much you need. Ad Compare Mortgage Options Get Quotes.

Clear information tailored to you. From what weve seen initial rates can vary from 146 to 219 for two. Bank loans hire purchase catalogues.

You can take out a mortgage for your share of the home and pay rent on the remainder. Housing providers and local authorities dont make the costs clear. Theyre also known as part buy part rent mortgages and are offered by housing associations.

It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Get Started Now With Quicken Loans. Total of service charge and rent.

Ad Compare Best Mortgage Lenders 2022. Buy between 25 and 75 of a property from a Housing Association. Apply Online Get Pre-Approved Today.

Were Americas 1 Online Lender. Shared Ownership mortgages are hard to understand. On top of this monthly mortgage payment youll also need to pay a monthly rent to the housing association.

You can now look for properties and mortgage products which fit these parameters. The shared ownership scheme allows people to buy a share in their home even if they cannot afford a mortgage on the entire value of the property. Save Time Money.

This is worked out as a percentage usually between 2 and 3 of the share. Before we can buy a place together we need to work out how much you can afford based on your income and outgoings. Shared ownership mortgages could allow you to buy between 25 and 75 of a property with.

The shared ownership scheme makes home ownership easier and more affordable for first-time buyers. Get Preapproved You May Save On Your Rate. If you find both congratulations from us and please contact us - we can help you with all aspects of your.

Total monthly credit commitments - eg. To secure a shared ownership mortgage youll typically need a 5 deposit or even 10 of the propertys value though all mortgage lenders will have different criteria. Ad Mortgage Rates Have Been on the Decline.

A 0 mortgage where the borrower could borrow up to 25 of the. See How Much You Can Save. The remainder of balance is provided by a lender who shares the equity.

Were Americas 1 Online Lender. Looking For A Mortgage. A shared ownership and rental calculator will help you determine the monthly repayments for your loan and your rent.

Ad Top-Rated Mortgage Companies 2022. Get Started Now With Quicken Loans. Looking For A Mortgage.

Compare Lowest Mortgage Lender Rates Today in 2022. Maintenance payments andor childcare costs. Get Top-Rated Mortgage Offers Online.

/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

Secured Vs Unsecured Lines Of Credit What S The Difference

Pros And Cons Of Joint Mortgages Loans Canada

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

Can I Get A Mortgage Canada How To Qualify

Shared Ownership Mortgages Share To Buy

/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

Secured Vs Unsecured Lines Of Credit What S The Difference

First Time Home Buyer In Ontario With Low Income Woodstreet Mortgage

![]()

Pros And Cons Of Joint Mortgages Loans Canada

Cristina Ferrara On Instagram Mortgage Interest Rates Have Dropped Considerably Over The Past Year Locking A Mortgage Interest Rates Interest Rates Mortgage

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

Key Terms To Know In The Homebuying Process Infographic Real Estate With Keeping Current Matters Home Buying Process Home Buying Real Estate Terms

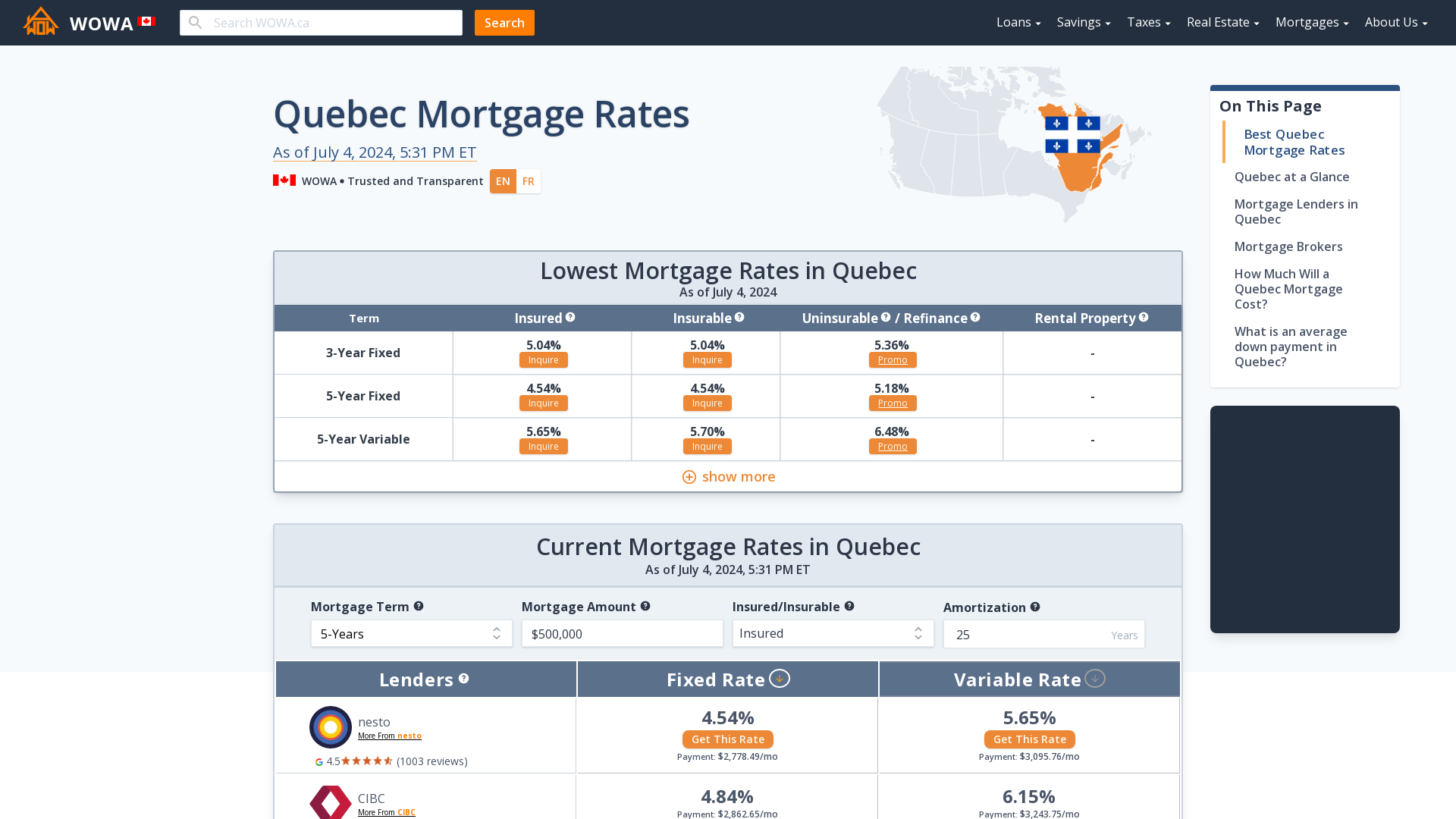

Current Quebec Mortgage Rates Compare The Best Rates From 25 Lenders

Mortgage Down Payment Calculator 2022 Mortgage Rules Wowa Ca

Spousal Buyout Of A Mortgage Loans Canada

Pin On Housing Market

Can I Get A Mortgage Canada How To Qualify

What Is Home Equity Wowa Ca